April 18, 2023

Authored by: Robert M. Schechter, JD and Maria Dermatis

Cross-border business structures and transactions often trigger compliance and reporting requirements. Here is information on certain of those reporting requirements issued by the United States Department of Commerce’s Bureau of Economic Analysis (BEA):

WHAT IS THE BEA?

The U.S. Bureau of Economic Analysis (“BEA”), an agency of the U.S. Department of Commerce, monitors inbound and outbound U.S. investments as part of its regulatory mission of tracking international commerce and publishing leading economic indicators such as GDP.

HOW DO I KNOW IF I HAVE A REPORTING OBLIGATION TO THE BEA?

Individuals and entities that meet any of the criteria below

have a BEA reporting obligation:

- U.S. persons and businesses holding a 10% or greater interest in a foreign (non-U.S.) business

- Foreign individuals and businesses holding a 10% or greater interest in a U.S. business

- Subsidiaries of any of the above references businesses

- U.S. parties that transact with foreign parties for the sale or purchase of services or intellectual property related rights.

Both direct and indirect cross-border business ownership interests can trigger reporting obligations.

WILL THE BEA CONTACT ME TO ALERT ME OF MY REPORTING OBLIGATIONS?

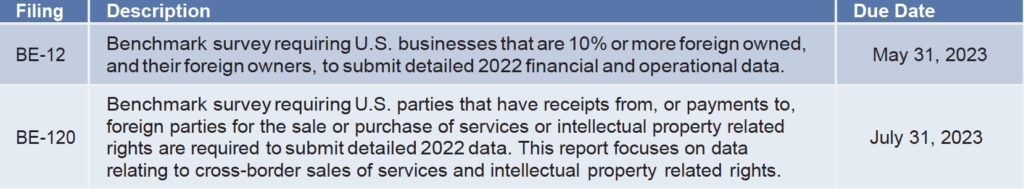

Only for certain reporting obligations. Benchmark surveys (reportable every 5 years) for all parties to cross-border business structures or cross-border transactions for services or intellectual property related rights are due with or without notice from the BEA. BE-12 AND BE-120 Benchmark surveys with 2022 data are due in 2023.

HOW CAN PORZIO COMPLIANCE SERVICES HELP ME WITH MY REPORTING OBLIGATION?

PorzioCS has developed a solution to assist clients with BEA reporting, bringing experience, efficiency and process to assist clients in the assessment and fulfillment of mandatory BEA cross-border business reporting requirements. PorzioCS’s BEA Compliance SaaS is a proprietary product that combines innovative technology with a highly skilled regulatory compliance team.

PorzioCS’s regulatory compliance team is dedicated to simplifying the BEA’s complex requirements and streamlining the filing process. Our goal is to significantly decrease our clients’ reporting burden and ensure compliance.

WHAT REPORTING OBLIGATIONS SHOULD I EXPECT IN 2023?

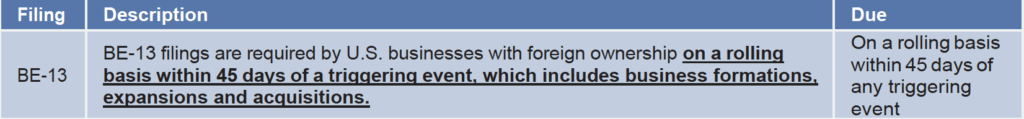

IMPORTANT TO REMEMBER:

OTHER REPORTING OBLIGATIONS MAY APPLY

Contact Porzio Compliance Services for Assessment of your specific reporting requirements.

Robert M. Schechter, JD

(609) 524-1838

RSchechter@porziocs.com

Maria P. Dermatis

(973) 889-4252

MDermatis@porziocs.com